Australia warns banks to restore trust as scandal inquiry continues

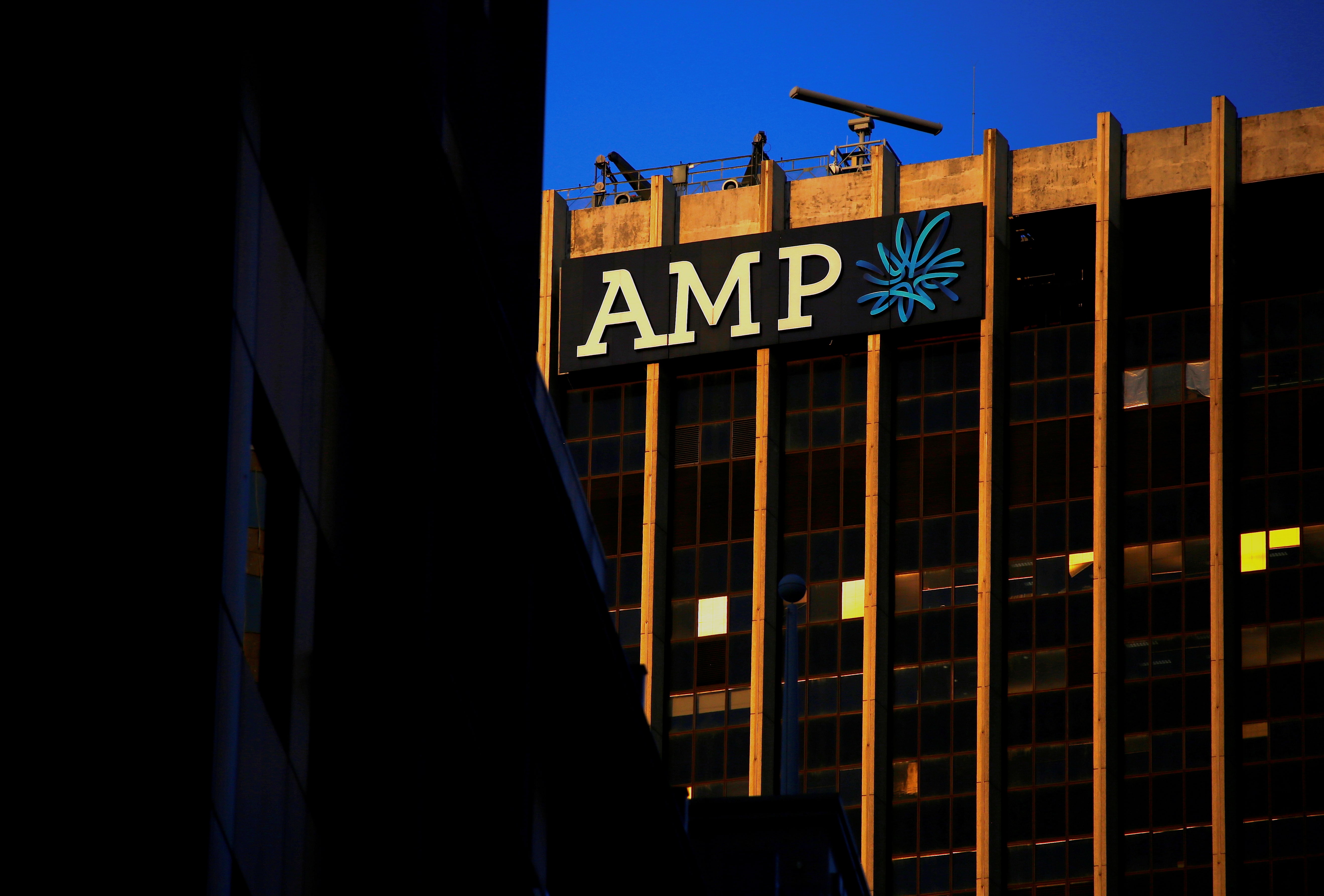

The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. (Photo: Reuters/ File Photo)

The logo of AMP Ltd, Australia’s biggest retail wealth manager, adorns their head office located in central Sydney, Australia, May 5, 2017. (Photo: Reuters/ File Photo) Australia’s financial services minister says that the country’s banks have a lot of work to do to regain the public’s trust as executives prepared for another day of grilling before a powerful inquiry into the scandal-hit sector.

Kelly O’Dwyer backed comments by Treasurer Scott Morrison that jail terms were possible after executives at AMP Ltd, Australia’s largest wealth manager, admitted it had lied to the corporate regulator to cover up charging thousands of customers for services they did not provide.

Commonwealth Bank of Australia, the country’s largest bank, also admitted to the inquiry earlier this week that it was the worst offender in misappropriating fees and also misled the regulator about it.

“Is it any wonder that people would be critical of those companies who have engaged in this sort of behaviour, absolutely not and it is not acceptable,” O’Dwyer told Australian Broadcasting radio.

“It is for them to explain how they are going to regain the trust of their customers,” she said.

Executives from Westpac Banking Corp, Australia’s oldest company, and Australia and New Zealand Banking Group are scheduled to be questioned today over cases where their senior advisers provided inappropriate counsel to clients.

In the past decade, over 80,000 consumers have been affected by bad advice, with losses totaling over $5 billion, according to the inquiry.

The government-backed Royal Commission into Australia’s banking sector is just a couple of months into what is expected to be a year-long investigation.

The inquiry will be able to make wide-ranging recommendations including legislative changes and for criminal or civil prosecutions.

Reuters