Australian wool prices plummet as Chinese mills seize control of bidding

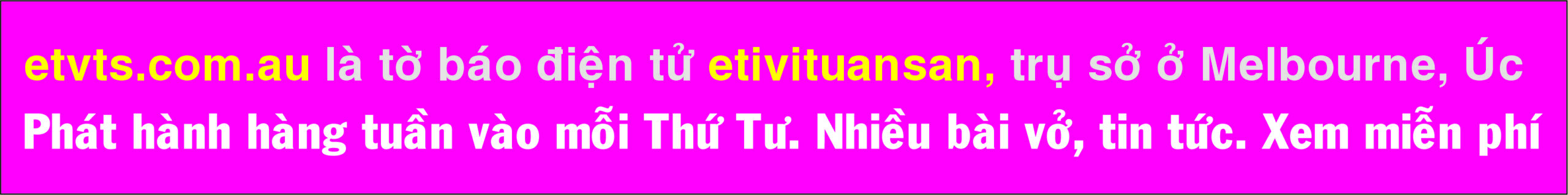

Traders buy bales of Australian wool at an auction in Yennora, Sydney, Australia August 14, 2019. (Photo: Reuters/ File Photo)

Traders buy bales of Australian wool at an auction in Yennora, Sydney, Australia August 14, 2019. (Photo: Reuters/ File Photo) SYDNEY – Wool prices in Australia, the world’s dominant exporter, have fallen more than 25% since early March after trade routes were abruptly cut amid the coronavirus pandemic, leaving Chinese wool mills in control over bidding.

The slowdown is so severe that wool auction houses across Australia have cut the number of trading days after the usual demand from high-end European tailors dried up.

Wool broker David Hart, from Nutrien Ag Solutions, told Reuters that Chinese buyers now controlled pricing.

“There’s a lack of competition at auction and they have the market to themselves,” said Hart, who attended the auction in the Sydney suburb of Yennora this week.

The benchmark price for merino wool traded at $11.55 per kg this week, auction results show, down from $15.62 per kg on March 6.

Prices have almost halved from a year ago, when global demand for wool products was soaring at the same time supply was under threat during a prolonged drought ravaging Australian farms.

Australia controls 90% of global fine-wool exports, where prices are largely driven by Chinese wool mills and Italian garment makers. The two countries purchase the majority of Australia‘s more than $3 billion in annual wool exports, although there are also buyers in India, South Korea and Japan.

Wool prices are particularly volatile and difficult to forecast, given there is no reliable data on inventory levels around the world.

Border closures during the pandemic meant they could not get Australian wool into most of their usual destinations, three traders told Reuters. They can, however, export to China, where the COVID-19 pandemic began, as Beijing re-ignites its manufacturing engines. COVID-19 is the respiratory disease caused by the novel coronavirus.

“Suffice to say China is the only show in town,” said Andrew Blanch, managing director of New England Wool, which is owned by an Italian textile maker.

Reuters